The US wants to stockpile critical minerals

Marcus Yam / Los Angeles Times

Basically the geopolitical version of extreme couponers. This week, the White House announced a first-of-its-kind $12 billion strategic stockpile of critical minerals, which are essential for advanced electronics, EVs, military tech, aerospace, and other key industries.

Why start hoarding now?

The initiative, called Project Vault, is designed to undercut China’s dominance over the critical minerals market (see graph), especially after Beijing leveraged the commodities in recent trade negotiations.

President Trump noted that the stockpile will help reduce reliance on China, which is the world’s largest producer of the materials, and help shield American companies from supply disruptions.

What’s gonna be in the stash? The reserve would stockpile rare earth elements like lithium, gallium, nickel, and cobalt, which are used in everything from iPhones and batteries to jet engines and semiconductors. See a list of the most important critical minerals for US national security here.

It will take a lot of money…

So it’s a good thing Uncle Sam has investors lined up around the block. Funding to help the US buy and store the minerals will come from around $1.7 billion in private capital and a $10 billion loan from the US Export-Import Bank.

The record-setting loan from the US Export-Import Bank (see explainer) is more than double the bank's previous largest deal.

Over a dozen big-name companies, like General Motors, Boeing, and Alphabet, have invested, while commodity traders Hartree Partners, Mercuria, and Traxys will source what goes into the vault.

It’s all a part of the plan: The stockpile is modeled on America’s Strategic Petroleum Reserve, and would carry two months’ worth of materials that US companies could draw on during emergencies.

🌎 Why is this important? Project Vault could help keep prices for everyday tech like phones, cars, and batteries more stable by reducing the risk of mineral shortages tied to China, while also supporting US manufacturing jobs. In the long run, it’s about making the economy less vulnerable to shocks that can quietly drive up costs for everyday Americans.

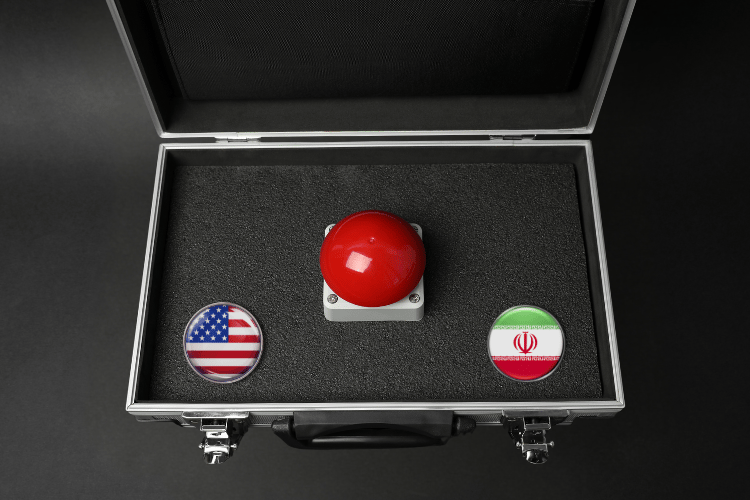

US and Iran to hold nuclear talks today

Designed by NextGen News

The meeting will mark only their second meeting since 2018. US and Iranian officials will meet in Oman today to hold rare face-to-face talks aimed at reviving negotiations over Iran’s nuclear program and easing tensions.

It comes at a turbulent time

The meeting follows weeks of heightened strain between the two countries amid Iran’s violent crackdown against anti-government protestors:

Iranian officials say as many as 30,000 civilians were killed in just two days, a rate not seen since Nazi Germany carried out mass executions in the 1940’s.

The US has repeatedly warned Iran it could face military action if the violence continues, recently deploying warships to the region and downing an Iranian drone that was allegedly targeting US ships.

Despite the escalating tensions, which have prompted the delay or cancellation of several planned meetings, officials have agreed on the need to move forward with negotiations.

What will they discuss?

The US is expected to carry out two rounds of talks with Iran, with one focused solely on its nuclear program and the other on human rights, its missile program, and support for militant groups.

However, trying to get both parties to meet has been a revolving door:

Iran has repeatedly insisted on keeping the discussions centered strictly on nuclear issues, per officials.

The two sides were also supposed to meet in Istanbul, but Iran recently urged moving the talks to Oman for undisclosed reasons.

Looking forward: White House envoy Steve Witkoff and adviser Jared Kushner are expected to meet with Iranian Foreign Minister Abbas Araghchi at around 10 am local time today.

🌎 What’s the takeaway? If talks succeed, calmer relations between the US and Iran could help keep gas and travel prices steady, reducing pressure on everyday expenses. If talks fail, rising tensions could push fuel and shipping costs higher and shake markets, meaning pricier goods, more inflation, and a tougher job market for Americans.

Walmart becomes the first retailer to hit $1 trillion

Designed by NextGen News

Looks like your online orders consisting of creatine and Diet Coke have piled up. Walmart surpassed $1 trillion in market cap for the first time, joining a club mostly dominated by Big Tech and making it the first traditional retailer to reach the landmark.

How did Walmart do it?

Walmart has joined the exclusive club (that’s dominated by tech giants) by transforming the company from a conventional brick-and-mortar chain into a tech-savvy retail platform.

Walmart has rapidly expanded into e-commerce, invested in automation and AI, and improved its online marketplace experience.

Now, the evolution of the big box retailer has it joining the ranks of other, more tech-forward businesses. I mean, if you can’t beat ‘em:

Walmart is just the 11th company in history to reach a $1 trillion valuation.

With that milestone, it is joining a club largely populated by tech heavyweights like Nvidia, Alphabet, Apple, and Microsoft.

What else got them to $1 trillion? The retailer also reported strong grocery sales and its appeal to both budget-conscious shoppers and higher-income households during periods marred by inflation.

🌎 Why does this matter? Walmart hitting a $1 trillion valuation means it will have even more power to shape everyday prices, shopping options, and job trends, likely pushing competitors to keep prices low while accelerating the shift toward online retail, automation, and delivery work. For you, that means cheaper essentials and more convenience, but also fewer local retail choices and a changing job landscape.

In partnership with Proton

Privacy-first email. Built for real protection.

Proton Mail offers what others won’t:

End-to-end encryption by default

Zero access to your data

Open-source and independently audited

Based in Switzerland with strong privacy laws

Free to start, no ads

We don’t scan your emails. We don’t sell your data. And we don’t make you dig through settings to find basic security. Proton is built for people who want control, not compromise.

Simple, secure, and free.

Your favorite chips are getting a bit cheaper

Designed by NextGen News

What’s better than a cheap bag of Doritos? PepsiCo said that it will cut prices on many of its signature snacks by up to 15% this week, hoping to win over customers ahead of the Super Bowl snacking season.

We've spent the past year listening closely to consumers, and they've told us they're feeling the strain,

Chip-flation

Executives at PepsiCo say they’ve been hearing from shoppers who are feeling the strain of higher everyday costs, especially at a time when many snack prices shot up due to inflation:

After surging by double digits in 2022 and 2023, PepsiCo’s prices have climbed another 4% on average over the past two years.

Meanwhile, retail prices for savory snacks have climbed more than 38% since 2020.

The decision to cut prices comes as shoppers increasingly choose cheaper store-brand alternatives over name-brand products to stretch their budgets, leaving big brands floundering to regain customer loyalty.

To win back some customers… PepsiCo will apply the discounts to most of its iconic products, including Lay’s, Doritos, Cheetos, and Tostitos. Additionally, the brand said package sizes will remain the same, meaning shoppers shouldn’t have to worry about that pesky shrinkflation.

Can’t pick a better time to discount: The Super Bowl is prime time for snacking. In 2024 alone, Americans shelled out about $670 million on snacks for the big game, with tortilla chips among the most popular picks.

🌎 Why should you care? This isn’t just about cheaper chips; it’s a sign of how persistent grocery inflation is still squeezing budgets (especially for everyday purchases) and how major companies are being forced to adjust in response to consumer pressure. It’s likely other brands will follow suit, which could shape broader cost-of-living trends down the line.

AI is making the software space crash out

Designed by NextGen News

It’s the beginning of the end. The rollout of new AI tools sparked a mass selloff of software stocks across the US, Europe, and Asia, as investors worry that rapid AI advances could upend traditional software companies.

Why the concern?

Anthropic’s new legal AI tool for its Cowork assistant (see here) can automate tasks like contract review, legal research, and drafting, which is spooking many investors who think software could be replaced by faster, cheaper AI tools.

Its release prompted a massive selloff, wiping almost $300 billion from the global software industry. The dump affected many markets:

A Goldman Sachs index tracking US software stocks fell 6%, its steepest one-day drop in almost a year, while a financial services index slid nearly 7%. The Nasdaq 100 at one point dropped as much as 2.4%.

Market data and analytics firms were hit particularly hard: London Stock Exchange Group dropped 6% after a 13% slide on Tuesday, S&P Global sank 11%, its worst fall since early pandemic days, and Thomson Reuters plunged 16%.

This isn’t a new issue: Tech companies have been introducing tools that let almost anyone build software regardless of technical experience (otherwise known as “vibe coding”). For markets, the quality of these tools matters less than their potential, as companies may use them to cancel expensive contracts with HR platforms, IT vendors, or even suites like Adobe.

🌎 Why is this important? The release of these new AI tools has some envisioning a future where many white-collar tasks get automated. For everyday Americans, their release means lower costs, faster services, and more accessibility, but also more pressure on entry-level office jobs and a labor market shifting toward AI-assisted roles rather than traditional career paths.

How did you like today's newsletter?

Catch up on this week’s weird news

GIF via GIPHY

> Research suggests those who identify with the Harry Potter houses Gryffindor or Slytherin are more likely to become entrepreneurs.

> Ring’s AI-powered Search Party feature, which uses a network of cameras to help find lost dogs, is now available across the US (even to those who don’t own a Ring camera) through the free Ring app.

> After years in the background, the humble minivan is finally having its moment… sales of the soccer mom-mobile jumped 21% last year as millennial parents increasingly demand spacious, practical vehicles.

> Svedka is set to air the first-ever AI-generated Super Bowl ad, starring its iconic Fembot and her new sidekick, the Brobot.

> Geologists find rivers are able to cut through mountain ranges because portions of Earth’s crust are so dense they start to sink under their own weight, a process known as “lithospheric drip.”