Finance

Short sellers lost billions betting against Tesla

The Washington Post via Getty Images

Say a quick prayer for those who shorted Tesla stock. Tesla’s stock ended last week up 26% (now up 28%), showing the longest stretch of gains the EV maker has had since summer of 2023.

Yesterday marked the 9th straight day of gains for the company, adding over $200 billion to Tesla’s value.

The streak has voided its losses for the year, and those who shorted the stock lost billions.

However, the company’s recent success in the market hasn’t necessarily translated to its other divisions.

Is Tesla still doing worse than expected?

While Tesla will certainly welcome its abrupt rise in share price, production issues and haphazard management have caused the company to falter from its once expected dominance.

While the EV maker’s Q2 deliveries exceeded analysts expectations by about 10,000, it’s still close to 5% less than Tesla made last year.

Tesla’s earnings per share is now hovering around $2, when, as recently as October, analysts were expecting the company to be making over $7 a share in 2024.

Annual revenue projections have also shot down, with estimates averaging around $99 billion, when just two years ago it was projected to be over $150 billion.

For the last seven quarters, demand for Tesla’s EVs has been stagnant, Chris McNally told Bloomberg. However, Elon Musk said in a post on X that the company is working on solving the plethora of issues, and those betting against the company “will be obliterated.”

Musk (and the market) remain optimistic

Musk has continuously reiterated that Tesla is hyper focused on its ride-hailing autonomous driving service and its humanoid robot, Optimus, which he says could “be more valuable than everything else combined.” I’m not sure if investors would love or hate to hear that.

As of right now, the company has set aside $10 billion toward AI research for this year, and Musk has said the ride-hailing service will be revealed next month. Tesla also plans to release lower-cost car models by early next year to combat flat demand.

Goodbye traditional investing, hello Gen Z

NextGen News

The new age of investing is here and it doesn’t involve what you might think. Gen Z and millennial investors with a lot of cash aren’t investing in the stock market, but instead in collectables.

Those two age groups are more than twice as likely to buy collectables as an investment than Gen X and Baby Boomers, according to a new Bank of America Private Bank survey.

New habits

The survey divided respondents into two age groups: those between 21 and 43 and those over 44. It then looked into the investing practices of more than 1,000 US citizens that carry an excess $3 million in investable assets.

Less than half (47%) of the younger age groups investments were held in stocks and bonds.

74% percent (ha, inverse) of the older age group’s portfolios were made of up stocks and bonds.

72% of the younger investors thought that it wasn’t possible to get “above average investment returns” by investing in stocks and bonds alone.

But Gen Z and millennial investors don’t only invest in collectables… around half of them said they own crypto.

Since younger people are typically more up to date with modern trends and financial mediums, it certainly checks out that Gen Z and millennial investors are likely to snatch up the newest meme coin and limited edition sneakers to gain a monetary edge on their peers. DOGE to the moon. Just kidding.

We’re halfway through 2024… how did stocks do?

Angela Weiss / AFP via Getty Images

Seeing as we’re a little more than halfway through the year, why not do a recap on our favorite financial assets? A few themes ran through the year, shedding light on what people invested in throughout H1.

What’s the breakdown?

Rate cuts were a big talking point. But did the lack of them matter? Not really. Investors expected the Fed to cut rates at least six times going into 2024, but there still hasn’t been one rate cut. Throughout the half, the S&P hit over 30 record closing highs, which is the second largest amount in the last 100 years.

Commodities did well: Last month gold hit a record high (and silver is close behind) and cocoa skyrocketed over 85% after shortages showed huge demand.

Currency did not: Against the US dollar, the value of the Japanese yen has plummeted to a 38-year low. Although new ETFs helped bolster Bitcoin, it’s getting stale.

The Dow has showed its age: In 2024, the 139-year-old index appears even more ancient, with companies like Boeing, Intel, and Nike seeing declines of over 30%. This year, the Dow has increased by less than 4%.

AI gets a goldstar: In H1, the S&P 500 returned an astounding 15%, yet more than 33% percent of the gain came from Nvidia alone. The chip maker shot up over 150% since the start of the year, and at one point it was the most valued in the US.

As for what’s to come? I’m not sure. If I did know, I would probably be in Mykonos sipping wine on my yacht.

Earn Free Gifts 🎁

You can get free stuff just by referring friends and family to our newsletter. Sweet deal right?

1 referral - NextGen News digital badge ✅

5 referrals - $5 gift card 💳

10 referrals - Luxury satin pillowcase 🛏

20 referrals - Carhartt beanie (of your choice) 🤠

{{rp_personalized_text}}

Copy and paste this link to share: {{rp_refer_url}}

Grab Bag

Welcome to inflation gambling

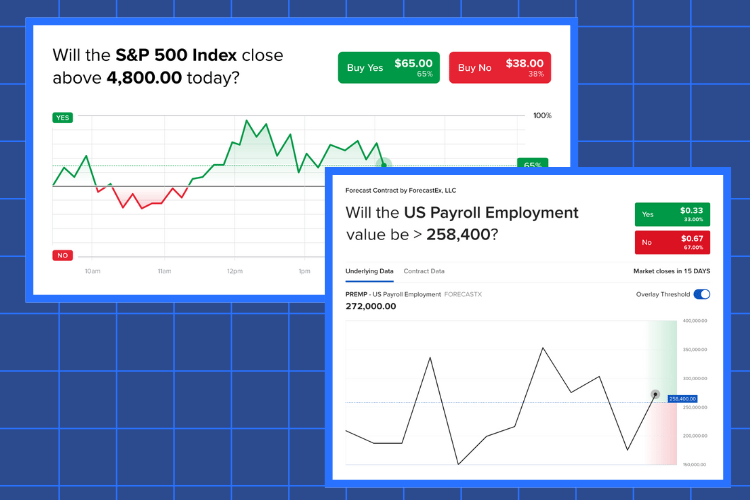

NextGen News / Interactive Brokers LLC / ForecastTrader

A whole new way to gamble has arrived. Sorry in advance to my fellow degenerates. Those who have a bit of cash to toss around (or don’t) can now bet on anything from economic indicators to CO2 levels using a new online prediction market called ForecastEx.

As of yesterday, customers are now be able to wager on future events by simply selecting “yes” or “no”, using commission-free penny contracts on the Interactive Brokers Group website.

How does it work?

Lets give you an example…

When looking at the image above, say you believe the S&P 500 will rise above 4,800 before the market closes.

You would then take a "yes" position and pay $0.65 for the 65% chances in your favor. If your (estimated?) guess comes true, you get a $1 payout, if it doesn't, then you get nothing in return.

But what can you bet on?

ForecastEx contracts will also cover global and national temperatures, atmospheric CO2 levels, as well as retail sales, unemployment, and other economic indicators in the US.

According to the statement, Interactive Brokers plans to cover "local and controversial global issues" and extend ForecastEx outside of the US. No word yet on if they’ll add the ± for the amount of kids Tyreek Hill will end up with though.

Big picture: 2021 saw the filing of more event contracts than the last fifteen years before it, and the count continues to rise.

Golf carts are asking for help

Andrew Redington / Getty Images

Even golf carts have to call in a presidential favor sometimes. According to Bloomberg, Club Car LLC and Textron Specialized Vehicles Inc., the nation's top two golf cart manufacturers, have requested that the Biden administration apply a 100% tax to Chinese-made golf carts, which they allege are hurting their sales.

What’s the deal?

Attorneys for both of the companies claim that (typically electric) Chinese golf cart manufacturers are evading high tariffs from the US by stripping the carts down to their most basic versions, and then modifying them in the US.

The Biden Administration applied a 100% tariff on Chinese EVs earlier this year, and Club Car and Textron want the same for the carts.

Chinese carts and related tiny vehicle imports increased from $148 million in 2020 to $916 million in 2023, according to the companies' filing with the US Trade Representative's office.

Speaking of tiny vehicles… The affordable, tiny Kei truck is a huge hit with Americans. The Japan Used Motor Vehicle Export Association reports that since 2019, kei exports from Japan to the US have more than tripled.

How did you like today's newsletter?

Fast Facts

Beary Cool: Why does honey come in bear-shaped bottles?

Disease Delivery: A new study found that a daily multivitamin or other supplements doesn’t increase your chances to live longer, they actually heighten your risk of disease.

Sample Satellite: SpaceX debuted its Starlink Mini, a portable $599 satellite internet antenna that fits in a backpack.

Lake Lovers: Here are the US’s best lake towns, according to Thrillist.

Ginger Gown: Virginia “Ginger” Hislop, a 105-year-old, finally got her master’s degree in education at Stanford University after 83 years of studying.